Definition of Financial Management

Managerial activities which deals with planning and controlling of firms and financial sources.

Financial management is an area of financial decision making, harmonsing individual motives and enterprise goals.

Scope of financial management

The scope and functions of financial management is classified in two categories.

-

- Traditional approach

- Modern approach

Traditional Approach

- According to this approach, the scope of the finance function is restricted to “procurement of funds by corporate enterprise to meet their financial needs.

- The term “procurement” refers to raising of funds externally as well as the inter related aspects of raising funds.

- The inter related aspects are the institutional arrangement for finance, financial instruments through which funds are raised and legal and accounting aspects between the firm and its sources of funds.

- In traditional approach the resources could be raised from the combination of the available sources.

Limitations of traditional approach

- This approach is confirmed to „procurement of funds‟ only.

- It fails to consider an important aspects i.e. allocation of funds.

- It deals with only outside I.e. investors, investment bankers.

- The internal decision making is completely ignored in this approach.

- The traditional approach fails to consider the problems involved in working capital management.

- The traditional approach neglected the issues relating to the allocation and management of funds and failed to make financial decisions.

Modern approach

- The modern approach is an analytical way of looking into financial problems of the firm.

- According to this approach, the finance function covers both acquisition of funds as well as the allocation of funds to various uses.

- Financial management is concerned with the issues involved in raising of funds and efficient and wise allocation of funds.

Main Contents of Modern approach

- How large should an enterprise be and how far it should grow?

- In what form should it hold its assets?

- How should the funds required be raised?

Financial management is concerned with finding answer to the above problems.

Functions of Finance

There are three finance functions

- Investment decision

- Financing decision

- Dividend decision

Investment Decision

- Investment decision relates to selections of asset in which funds will be invested by a firm.

- The asset that can be acquired by a firm may be long term asset and short term asset.

- Decision with regard to long term assets is called capital budgeting.

- Decision with regard to short term or current assets is called working capital management.

Capital Budgeting

- Capital budgeting relates to selection of an asset or investment proposal which would yield benefit in future. It involves three elements.

- The measurement of the worth of the proposal.

- Evaluation of the investment proposal in terms of risk associated with it and

- Evaluation of the worth of the investment proposal against certain norms or standard. The standard is broadly known as cost of capital

Financing Decision

- Determination of the proportion of equity and department is the main issue in financing decision.

- Once the best combination of debt and equity is determined, the next step is raising appropriate amount through available sources.

Working Capital Management

- Working capital management or current asset management is an important part of investment decision.

- Proper management of working capital ensures firm‟s liquidity and solvency.

- A conflict exists between profitability and liquidity while managing current asset.

- If a firm does not invest sufficient funds in current assets it may become illiquid and may not meet its current obligations.

- If the current asset are large, the firm would lose its profitability and liquidity.

- The financial manager should develop proper techniques of managing current assets so that neither insufficient nor unnecessary funds are invested in current assets.

- If a firm does not invest sufficient funds in current assets it may become illiquid and may not meet its current obligations.

- If the current asset are large, the firm would lose its profitability and liquidity

- The financial manager should develop proper techniques of managing current assets so that neither insufficient nor unnecessary funds are invested in current assets.

The management of working capital has two aspects.

- Overview of working capital management and

- Efficient management of individual current asset such as cash, receivable and inventory.

Financing Decision

- Financing decision is concerned with the financing mix or capital structure.

- The mix of debt and equity is known as capital structure

Dividend Decision

- A firm distribute all profits or retain them or distribute a portion and retain the balance with it.

- Which course should be allowed? The decision depends upon the preference of the shareholders and investment opportunities available to the firm.

- Dividend decision has a strong influence on the market prize of the share.

- So the dividend policy is to be determined in terms of its impact on shareholder’s value.

- The optimum dividend policy is one which maximizes the value of shares and wealth of the shareholders.

- The financial manager should determine the optimum pay out ratio I.e. the proportions of net profit to be paid out to the shareholders.

- The above three decisions are inter related. To have an optimum financial decision the three should be taken jointly.

Objectives of financial management

The term “objective” refers to a goal or decision for taking financial decisions

- Profit maximisation

- Wealth maximisation

Profit maximisation

- The term profit maximisation is deep rooted in the economic theory.

- It is need that when firms pursue the policy of maximising profits.

- Society‟s resources are efficiently utilised.

- The firm should undertake those actions that would profits and drop those actions that would decrease profit.

- The financial decisions should be oriented to the maximisation of profits.

- Profit provides the yardstick for measuring performance of firms.

- It makes allocation of resources to profitable and desirable areas.

- It also ensures maximum social welfare.

Wealth maximisation

- Wealth maximisation or net present value maximisation provides an appropriate and operationally feasible decision criterion for financial management decisions.

Sources of Finance

- Capital required for a business can be classified under two main categories, viz.,

– Fixed Capital, and

– Working Capital.

- every business needs funds for two purposes.

- for its establishment and to carry out its dayto- day operations.

- Long term funds are required to create production facilities through purchase of fixed assets such as

– plant,

– machinery,

– land,

– building,

– furniture, etc.- Investment in these asset represent that part of firm’s capital which is blocked on permanent or fixed basis and is called fixed capital

- Funds are also needed for short-term purposes for the purchase of raw materials, payment of wages and other day to day expenses, etc. These funds are known as working capital.

- In our present day economy, finance is defined as the provision of money at the time when it is required.

- Every enterprise, whether big or medium or small, needs finance to carry on its operations and to achieve its targets.

- In fact finance is so indispensable today that is rightly said that it is the life blood of enterprise.

- With out adequate finance, no enterprise can possibly accomplish its objectives.

- In every concern there are two methods of raising finance, viz.,

Raising of owned capital,

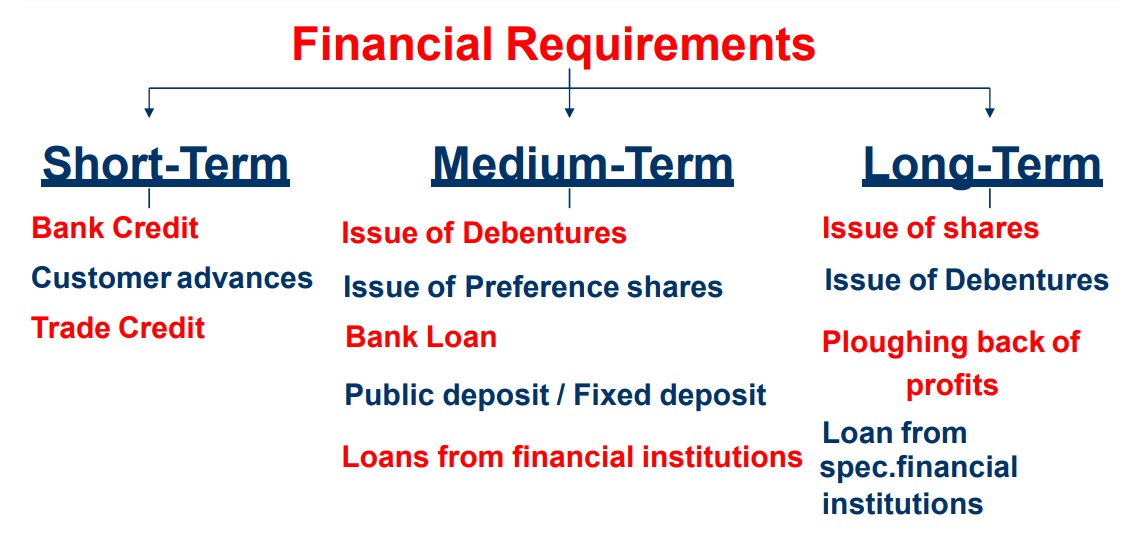

Rising of borrowed capitalThe financial requirements may be for a long term, medium term or short term.