-

Announcement : Admission Open Apply Now

Pratibha Samman Samaroh– 2024

Pratibha Samman Samaroh– 2024

Critical Analysis of the Failure of Air India Limited

Congratulations For Got Bronze Medal of 58kg and 74kg weight category in All India Inter University Grappling

April 4, 2022Free of cost certificate courses started at OSGU

April 22, 2022

Critical Analysis of the Failure of Air India Limited: A Case Study

INTRODUCTION

In India, the civil aviation industry has emerged as one of the country’s fastest expanding industries. According to the International Air Transport Association (IATA), “India is expected to overtake China and the United States as the world’s third- largest air passenger market in the next ten years, by 2030”. The FDI inflow to India’s air transport sector amounted to US $2.95 billion between April 2000 and March 2021, based on information given by the Department for Promotion of Industry and Internal Commerce (DPIIT). It is expected that India will be the third largest aviation market inthe world by 2024. In terms of market share, IndiGo, Air India, SpiceJetand GoAir are the main players in India’s aviation industry.

Air India (formerly known as Tata Airlines) was founded inthe year 1932 by JRD Tata. The Haviland Puss Moth was the first plane that was used by Tata Airlines. It was incorporated in 1932 with the name Tata Air Mail. On October 15, 1932, the first flight was flown by the company from Karachi to Bombay. This first flight was flown by JRD Tata himself. JRD Tata was the first pilot of the India &Verma Aero -club of India. The company was initially engaged in the mail (delivering mail). In the year 1938, Tata Air Mail became Tata Air Lines, and they expanded their business. The company became a public company in the year 1946 and renamed as Air India. In June 1948, it expanded its international flights by flying a planto London.

In the year 1953, the Govt. of India introducedthe Air Corporation Act, and under this Act, the government nationalized Air India. As the company was incorporated byJRD Tata, the government appointed Mr. JRD Tata as theChairman of Air India,In the year 1978, when Morarji Desai was the Prime Ministerof India, JRD Tata was removed from the post of Chairmanof Air India. When JRD Tata left Air India, the companysuffered a setback. In the year 1980, JRD Tata was againreappointed to the Board of Directors of Air India. In 1994, theAir Corporation Act 1953 was replaced by the Air CorporationAct 1994, under which private companies are also welcomedinto the aviation sector to expand the aviation sector.

Withthe introduction of this Act, many domestic companies havecome into this sector, which has created great competition forAir India. In 2007, Air India and Indian Airlines were mergedand named as the National Aviation Corporation of IndiaLimited (NACIL).In 2007, Air India faced a loss of 541 crore and IndianAirlines had a loss of 240 crore. The company was at a lossfor many years and had a large amount of debt. Becausethe company was unable to pay the debt, the governmentprovided a bailout package each year to run the company.The Indian government attempted to privatize Air Indiaseveral times, but only on the condition that the governmentsell 76% of the company’s shares while keeping 24% ofthe company’s shares. But under this condition, no buyercomes in front. In 2021, the government revised its policyon privatization and was ready to sell the entire 100% shareof Air India. M/s Talace Pvt. Ltd. a wholly owned subsidiaryof Tata Sons, was the highest bidder for the Air India EVARs. 18,000 crore. As the Tata sons’ bid was the highest tobuy Air India for a price of Rs.18000 crore, they acquiredthe airline back. The divestiture of Air India will take placethis year.

COMPANY’S JOURNEY

- In 1932, Tata Air Mail founded by JRD Tata.

- In 1933-35, Haviland Leopard Moth OH-8S &Haviland Fox Moth DH-83 was introduced.

- In 1937, AirIndiaexpands its route to Bombay Indore, Bhopal Gwalior & Delhi.

- In 1937, Waco YQC-6 was also introduced by the company.

- In 1946, Tata Air lines is named as Air India & in 1948 Air India Ltd. was formed

- In 1953, Air India was nationalized and splits its operation in 2 parts, Domestic and International

- In 1996, company started its second gateway at O’ Hare International Airport a Chicago,

- In 2007, Air India Merged with other domestic airlines

- In 2012 Indian government grant $ 5.8 billion bailout package for the company.

- In 2018, the govt. offer to sale 76% share of Air India but no single buyer comes in front to buy

- In 2019 government of India decided to sell entire 100% share after finding no buyer agreed at 76%.

- In 2019, India news to sell Air India, In 2020 government gets two buyer who are agreed to buy 100%share

- In 2021, Tata Sons acquire the Air India with the highest bid of 18,000 crore.

RESEARCH METHODOLOGY

The study examines the past ten years (from 2011-2020) of annual reports and financial statements of Air India. The study used secondary data from sources such as the EMIS Database and Annual Reports of the company. The methodology involves the study of ratio analysis, capital structure and calculation of Altman’s Z score and its comparative analysis with other two top air transport companies i.e. InterGlobe Aviation Ltd. (Indigo) and Spicejet Ltd.

Analysis of Data

Ratio Analysis

The Summery of various ratios and expenses as a ratio of sales are given in table 1.

| Table 1: Various Ratio of major competitor companies in Aviation Sector | ||||||

| Current Ratio | ||||||

| Company / Year | 31-3/2020 | 31/03/2019 | 31/03/2018 | 31/3/2017 | 31/03/2016 | Average |

| Air India Limited | 0.44 | 0.55 | 0.92 | 0.73 | 1.16 | 0.76 |

| InterGlobe Aviation Ltd. | 0.43 | 0.81 | 0.89 | 0.87 | 1.02 | 0.79 |

| Spicejet Ltd. | 0.30 | 0.70 | 0.69 | 0.44 | 0.4 | 0.60 |

| Average | 0.37 | 0.76 | 0.79 | 0.66 | 0.71 | 0.69 |

| Debt to Equity Ratio (%) | ||||||

| Air India Limited | -196.00 | -121.88 | -209.62 | -231.60 | -299.71 | -263.61 |

| InterGlobe Aviation Ltd. | 6.02 | 31.70 | 31.67 | 63.39 | 110.42 | 348.61 |

| Spicejet Ltd. | -55.33 | -277.91 | -2.00 | -168.81 | -98.75 | -210.36 |

| Average | -24.66 | -123.11 | 14.84 | -52.71 | 5.84 | 69.12 |

| Interest Coverage Ratio | ||||||

| Air India Limited | -0.98 | -0.8 | -0.17 | 0.05 | 0.13 | -0.65 |

| InterGlobe Aviation Ltd. | 0.03 | -1.9 | 7.41 | 5.1 | 8.59 | 6.32 |

| Spicejet Ltd. | -2.27 | -3.92 | 10.37 | 7.83 | 6.04 | 2.86 |

| Net Profit Margin (%) | ||||||

| Air India Limited | -28.02 | -33.22 | -23.20 | -26.37 | -19.19 | -30.64 |

| InterGlobe Aviation Ltd. | -0.69 | 0.55 | 9.74 | 8.93 | 12.31 | 7.06 |

| Spicejet Ltd. | -7.56 | -3.47 | 7.27 | 6.96 | 8.84 | -3.23 |

| Average | -4.13 | -1.46 | 8.51 | 7.95 | 10.58 | 1.92 |

| Return on Capital Employed (%) | ||||||

| Air India Limited | -25.67 | -58.22 | -2.79 | 0.86 | 1.72 | -14.19 |

| InterGlobe Aviation Ltd. | 1.04 | -10.49 | 26.01 | 26.61 | 44.45 | 24.00 |

| Spicejet Ltd. | 110.49 | -129.22 | 85.78 | 206.53 | -303.27 | -47.04 |

| Average | 55.77 | -69.86 | 55.90 | 116.57 | -129.41 | -11.52 |

| Administrative Expenses to Net Sales (%) | ||||||

| Air India Limited | 53.30 | 58.53 | 54.78 | 49.11 | 46.92 | 37.85 |

| InterGlobe Aviation Ltd. | 32.94 | 38.72 | 41.36 | 41.99 | 38.59 | 37.34 |

| Spicejet Ltd. | 24.87 | 31.11 | 29.31 | 32.09 | 31.19 | 30.64 |

| Average | 28.91 | 34.92 | 35.34 | 37.04 | 34.89 | 33.99 |

| Depreciation and Amortization to Net sales (%) | ||||||

| Air India Limited | 15.49 | 6.23 | 7.25 | 7.36 | 9.34 | 9.92 |

| InterGlobe Aviation Ltd. | 11.11 | 2.67 | 1.90 | 2.46 | 3.13 | 2.92 |

| Spicejet Ltd. | 14.03 | 2.81 | 2.97 | 3.21 | 3.53 | 3.39 |

| Average | 12.57 | 2.74 | 2.44 | 2.84 | 3.33 | 3.16 |

| Interest paid to Net sales (%) | ||||||

| Air India Limited | 14.14 | 18.47 | 19.41 | 19.38 | 22.38 | 20.88 |

| InterGlobe Aviation Ltd. | 5.25 | 1.79 | 1.48 | 1.78 | 1.88 | 1.68 |

| Spicejet Ltd. | 4.41 | 0.49 | 0.50 | 0.53 | 2.02 | 1.60 |

| Average | 4.83 | 1.14 | 0.99 | 1.16 | 1.95 | 1.64 |

Source: EMIS Database

In the above table, the average (Horizontal) of the other two companies have been completed, excluding Air India Limited of all companies from 2011-2020 and the average (Vertical) of the other two companies, excluding Air India Limited.

The current ratio and liquid ratio show the short-termsolvency position of the organization. From the above table,we can see that almost all the years, the current ratio and liquidity ratio of Air India Ltd. are as per the industry average.

The debt to equity ratio shows the long-term solvencyproblem of the organization. From the above table, we cansee that the company has too high debt as compared tothe other companies. This is an indicator of high-interestobligations on the part of the organization. As the debt is toohigh as compared to the other organizations, the risk level forthe investment in Air India Ltd. is also high.

The Interest Coverage Ratio shows the capability of theorganization to pay the interest expenses payable by theorganization. A high ratio is an indicator of the capability ofthe organization to pay the interest amount. We can interpretfrom the above table that the ratio is too low in all years for AirIndia Ltd. This is not a good indicator of the financial healthof the organization.

Net Profit Margin shows the profitability of the organization. Thehigher the ratio,better for the organization. From theabove table, we can interpret the average net profit margin ofAir India Ltd. is too low as compared to the other organizations.For all the years of study, the net profit margin is negative. It isnot a good indicator for the organization, as without profits, noorganization can survive for a long period of time.

Return on Capital Employed shows the company’sprofitability and capital efficiency. The higher the ratioindicates strong profitability. From the above table, we cansee that the ratio of the Air India Ltd. is negative for 8 yearsout of the 10 year study period. This is again not a goodIndicator for the organization.

Administrative Expenses to Net Sales shows the amountof expenditure on administrative expenses as a ratio to netsales. From the above table, we can see that the averageexpenditure of Air India Ltd. is comparative to the otherorganizations.

Depreciation and Amortization to Net Salesshows theamount of depreciation and amortization as a ratio to netsales. From the above table, we can see that the averageamount of expenditure on depreciation and amortization ofAir India Ltd. is high as compared to the other organizations.The amount is almost three times the average of otherorganizations, which is not a good sign for the organization.

Interest paid to Net Sales shows the amount of expenditureof payment of the interest on borrowing by the organizationas a ratio to net sales. From the above table, we can see thatthe burden of interest payments on sales is very high for AirIndia Ltd. This is not a positive sign for the organization as themajority of the sales revenue is utilized for the payment of theinterest burden.

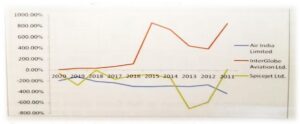

Capital structure

As we know, the capital structure has a significant impact on the profitability of the organization. We can see in the below graph a very high debt-equity ratio of Air India Ltd. as compared to the other companies in the industry. Due to high debt, the interest expenses increased too much, which created problems for the survival of the company. The higher cost of debt increases the weighted average cost of capital higher and higher.

Figure: 1- Debt Equity Ratio

CONCLUSIONS AND RECOMMENDATIONS

CONCLUSIONS AND RECOMMENDATIONS

From the above, we can conclude that the company was in a turbulent financial condition. The finance costs and other costs are very high as compared to the other companies in the industry. Despite heavy losses, the company raised more and more debt. The interest coverage ratio was too low to survive. The net profit margin was negative. All the above facts were very clear without any analysis. Anyone can tell by looking at the financial statement that Air India’s financial condition is not sound. We recommend assessing the creditworthiness of a company by using Altman’s Z score. The study also recommends that organizations keep a close eye on the amount of debt, as with the increased amount of debt comes an increase in the interest payment burden also. So it is advised not to rely too much on debt, as the reason behind most companies’ failures is excessive debt.

BIBLIOGRAPHY

- https://www.ibef.org/industry/indian-aviation.aspx

- https://www.civilaviation.gov.in/

- https://www.tata.com/newsroom/business/air-india

- https://economictimes.indiatimes.com/industrytransportation/airlines-l-aviation/deconstructing-the-

deal-what-air-india-takeover-means-for-tata-group/articleshow/86868322.cms? from=mdr

- https://www.business-standard.com/article/companies/tata-sons-board-takes-stock-of-air-india-acquisition-121101201259_1.html

- https://www.thehindubusinessline.com/economy/logistics/tata-sons-wins-bid-to-acquire-air-india/article36895731.ece